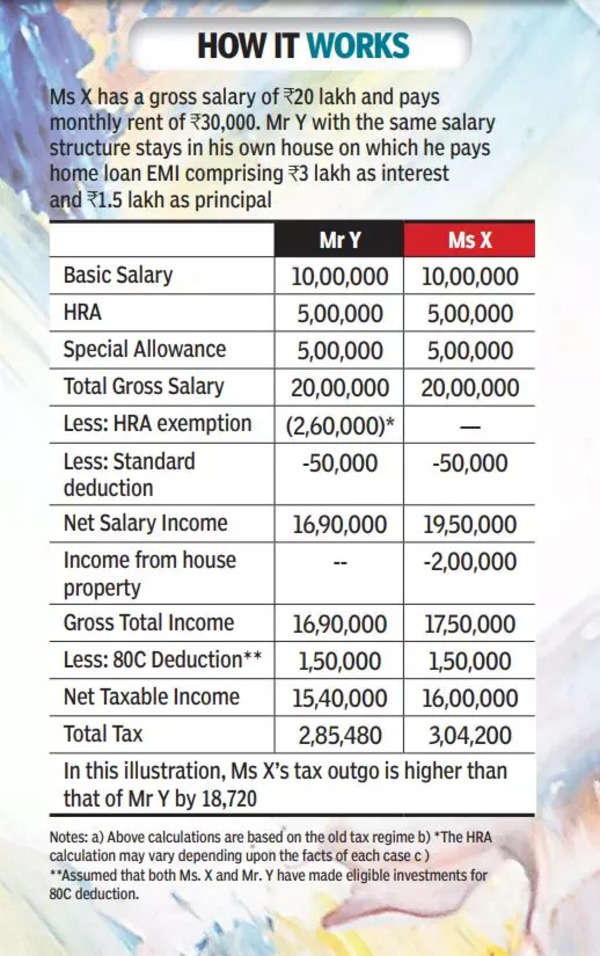

Rent a home or buy one, that is a dilemma as complicated as the one Hamlet faced. And he didn’t even have a stiff EMI hanging over head. So, should one spend a big sum on a house property – especially with the help of a home loan– given that the capital appreciation in many towns is not as significant as it once was? Isn’t living on rent, perhaps closer to the office easier? On the other hand, an investment in a house property is a secured and tangible investment. Plus, a house is not just four walls; there is a lot of emotion attached to it. From the tax perspective both have their pros and cons

STAYING ON RENT

Usually employers provide House Rent Allowance (HRA) as it is a tax-efficient salary component. But, in case your cost-to-company salary package does not contain HRA, a deduction for rent paid, is available from gross taxable income of up to 5,000 a month. Certain conditions are set, such as the individual should not own a property in the same location as the workplace.

TAX BENEFITS: Those staying on rent can avail of an exemption against the HRA received and only the balance will be taxable. The exemption is limited to the lowest among:

- Rent paid less 10% of salary (basic salary and DA)

- 50% of salary if the house is situated in Delhi, Mumbai, Kolkata or Chennai or 40% of salary in other cities.

- Actual HRA received. However, the HRA exemption is not available to taxpayers who opt for new tax regime.

PROS:

- Rent may be lower than home loan EMI

- Choice of a more central location as homes for purchase are usually affordable only in suburbs

- Provides ease for relocation

- Tax benefits are available

CONS:

- No asset creation

- Annual rise in rent leading to increase in cash outflow

- No freedom to make structural changes to house

- Landlord can ask you to move on short notice

BUYING A HOUSE

TAX BENEFITS: If a house property is purchased availing a home loan, there are multiple tax benefits associated with the purchase. Equated Monthly Instalments (EMIs) are typically divided into principal (the amount you took as loan) and interest (the cost of servicing the loan).

ON PRINCIPAL REPAYMENT: Deduction under Section 80C, for amount paid on principal repayment, stamp duty, registration fee and other expenses for the transfer of such house property, are allowed up to 1.5 lakh per year.

ON INTEREST PAID: In case of a self-occupied house property, the taxpayer is eligible to get deduction of interest paid on housing loan up to Rs 2 lakh per annum, which can be set off against any other income. (In case the house property is let out, the taxpayer is eligible to claim deduction for interest paid on housing loan, municipal tax paid and standard deduction of 30% of the rental income).

For first-time home buyers, an additional deduction up to 1.5 lakh under Section 80EEA can be claimed for interest paid on housing loan, provided that the loan was sanctioned between April 01, 2019 and March 31, 2022, for buying a residential house property whose stamp duty value was 45 lakh or less.

Note: Deductions not available under New Tax Regime

SET-OFF AND CARRY FORWARD OF LOSS: In case of a self-occupied property, where a home loan has been taken, in the absence of any rental income from the property, deduction of the interest will result in a loss. The total loss from house property (either self-occupied or let-out), which can be adjusted against any other head of income (such as salary, income from other sources) during a financial year has been capped at 2 lakh. The remaining amount of loss (if any) can be carried forward for eight subsequent assessment years and can be set-off only against ‘Income from house property’.

FORK OUT NOTIONAL RENT: It is important to remember that, in case an individual owns more than two house properties, the concept of notional rent comes into play. In such cases, two properties can be considered as ‘self-occupied’ and remaining property/properties, even if not let out, will be treated as ‘deemed let-out’ and notional rent (based on expected market rent) becomes a taxable income.

PROS:

- Create an asset rather than pay rent to a stranger

- Tax benefits available against repayment of home loan and payment of interest

CONS:

- Besides the upfront cost of purchase and registration, payment of property taxes on a regular basis, renovations and repairs are additional cost

- Low liquidity in case of a sudden need

- There is no guarantee that the property price will rise, hence the asset may not fetch required return on investment

- One has to pay EMI even in event of job loss/income fluctuations. No option of moving to a lower-rent place

Source: TOI